Before I get into today’s discussion, I want to say that I’m going to add to my last post with an audio recording because I need a microphone for this one:

Otherwise, today I want to talk about Web3 or the ‘new iteration’ of the internet. You’ll hear Web3 referenced in various ways, typically, blockchain, ethereum, bitcoin, the metaverse, and many other terms. Cryptocurrency, virtual reality are some other words that come to mind.

But what Web3 is, in essence describing, is the internet run on the blockchain. Go figure. And blockchain is what?

Earlier today, I was in a conversation with a few people, including Aaron Levie, the CEO, and Founder of the publicly traded company, Box, Inc.(NYSE: BOX.)

Now, I didn’t record the conversation, and I won’t be quoting anyone directly. More so, my objective in writing you at this moment is to provide you with some of my takeaways.

My contributions to the conversation of web3 are usually in corporate finance, governance, and regulation. I spent about six years of my life climbing in, around, and through layers of bureaucracy, compliance, and regulation while installing technology into corporations. I even breached a few of their networks, not intentionally, but I did. So my bias of the conversations on Web3 is because of the parts I am interested in - not because they are the only parts worth considering.

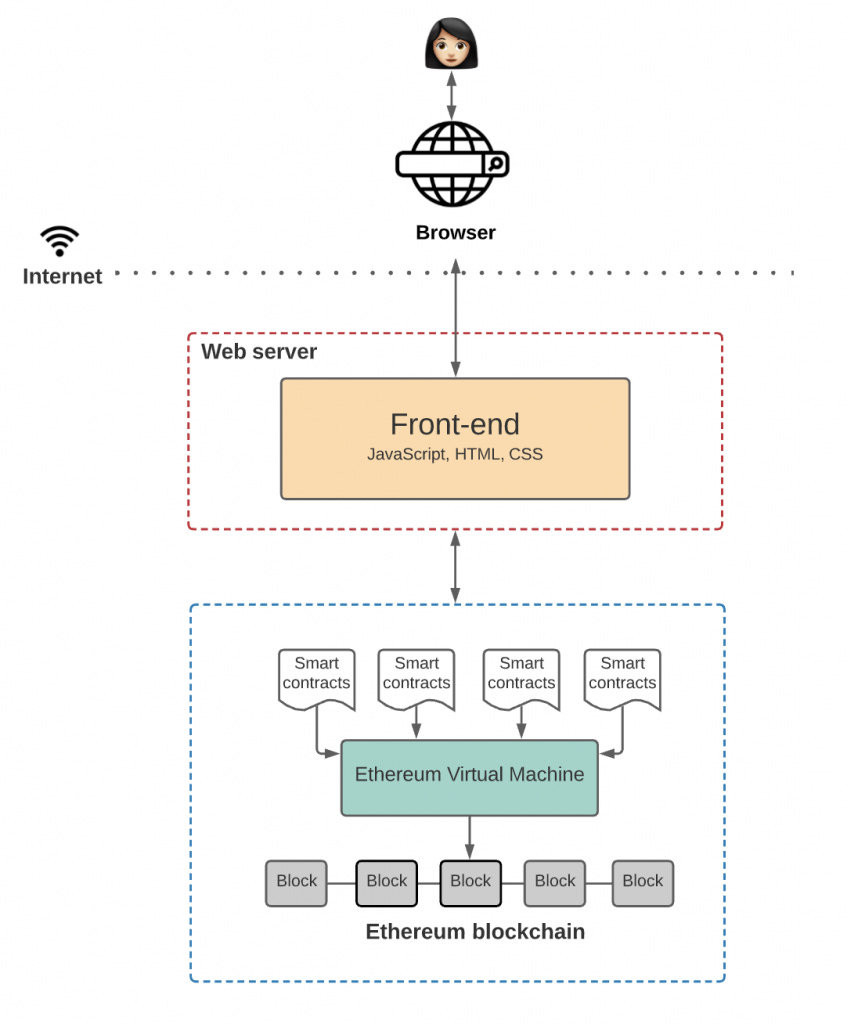

Web3 is being discussed by many as a desired future state. These same people describe Web3 like it is here now when in reality, there is an architecture that exists:

Although simplified, this architecture is the backbone of every single Web3 conversation, even cryptocurrency.

And a lot of the ways it is described are aspirational, and they are more an expression of philosophy or ideology than anything else.

You may hear references like “decentralized” or “access for all” or “true equality.”

Maybe you’ve heard something else like, “You have to get in now. It just keeps going up.”

Whatever it is, they’re referencing what is taking place on the blockchain.

In one of my earlier posts, I mentioned a gaming company called Sandbox.com. Sandbox is a perfect example of Web3, and it’s a game built on top of a ‘blockchain.’ The currency used for transacting on this blockchain is known as SAND. Sand is a financial instrument that allows individuals to transact directly with other individuals without any middle man in the transaction.

Traditional banks can’t perform this same transaction currently. That’s not to say that they will need to, but in the case they do, they’re already throwing billions of dollars into Web3 investments. $27B according to Fortune.com.

For example, inside Sandbox.com, individuals are buying real estate. Look at this - here is a website that lists the properties available in multiple metaverse games for sales or rent. Seriously? How will CBRE (NYSE: CBRE) or JLL (NYSE: JLL) respond to this?

AND IN CASE YOU DIDN’T KNOW

Venture Capital backs these metaverse games.

According to Crunchbase, here is a simple representation of how the venture capital is allocated:

Gaming: about $7.5 billion (382 rounds)

Online Games: about $2.5 billion (110 rounds)

Augmented reality: about $2.1 billion (176 rounds)

Virtual world: $62.8 million (9 rounds)

That’s a lot of money for an idea that doesn’t exist yet. And the idea is to create games that have economies inside of them that replace current reality and create an environment where people can sustain themselves for most of the day. Oh, and let’s not forget that this environment gives people access to equality. An entire sector of people actively promotes a “creator economy.” Now I don’t doubt the existence of the creator economy, and I am a product of it. It’s just I’m not required to play games on a currency in an environment structured as a Delaware S-Corp that wants to take over my waking life. What are the implications of this!!!!!

LOL

No, seriously.

Suppose Venture Capital is investing in these metaverse games. In that case, they need to make their money back, meaning they need massive adoption to achieve outsized returns on a small percentage of their investments. Otherwise, their funds fail, and they lose money.

I still have many unanswered questions, but I’ll continue to explore those with you over time. If you’ve been reading this for any length, you know that my ideas aren’t always complete, and I tend to examine the broader structure and consider what happens as the various parts interact with each other.

Anyway, I’ll send out my recorded views on the Trump SPAC in the next couple of days.

As always, leave a comment, like, reply to me directly and follow me on socials. Find me here.

Esteemed writer and author Christopher Sweat delves deep into the new technology era that is sweeping the nation and soon, the world. We’ve all heard of the spider-verse, but until recently know one had a clue what the meta-verse was or how to be apart of it/invest in it. Companies like Roblox are pioneering the new age. Facebooks Mark Zuckerberg is so bullish on the meta-verse that he changed the name of Facebook to Meta. We are still years away from mass adoption, but the early signs show that this is going to be a booming industry. There are already folks who have went to virtual reality concerts, and one individual who purchased a virtual Yacht for $910,000 named ‘The Metaflower Super Mega Yacht’. Times are changing folks, and they’re changing fast. Fasten your seat belts, it’s going to be one hell of a ride into what this could end up being.